(719) 301-9303

Personalized services to meet unique health insurance needs

Personalized services to meet unique health insurance needs

Personalized services to meet unique health insurance needs

How may I help you? Below is a partial list of services offered:

How may I help you? Below is a partial list of services offered:

Starting Medicare

As you prepare for Medicare, I can assist with:

Determining your Medicare eligibility

Avoiding Late Enrollment Penalties (LEPs)

Understanding Medicare’s benefits and limitations

Enrollment in Original Medicare (Parts A & B)

Completion of necessary CMS forms

Deciding between a Medicare Supplement (“Medigap”) and a Medicare Advantage plan

Comparing and selecting Medicare plans (Part C, Part D, and Medicare Supplements)

Special situations

There are unique Medicare considerations for certain groups of people. I can provide the necessary, specialized guidance for those with:

VA benefits (veterans)

Tricare for Life

Long-Term Disability through SSA

PERA

Medicaid

ALS or end-stage renal disease

Client support

Enrolling in Medicare is just the beginning. I support you throughout your Medicare years by:

Addressing questions, issues, and concerns as they arise

Providing continued Medicare support & advocacy

Regularly reviewing your health insurance needs and coverage

Informing you of changes that impact you, such as Medicare law and policy updates, as well as insurance industry, carrier, and network changes

Annual Enrollment Period (AEP)

Each year from October 15 to December 7, Medicare beneficiaries have the opportunity to make changes to their plan choices for the following calendar year. It’s also the time when marketing is in full force for Medicare-related insurance products. The barrage of commercials, mailers, and unsolicited (illegal) sales calls all signal that it’s AEP time!

During AEP, I can help by:

Sorting fact from fiction with marketing claims

Reviewing your plan’s ANOC (Annual Notice of Change)

Discussing how your current plan’s benefits, cost-sharing, and coverage will change for the upcoming year (if applicable)

Re-evaluating your situation, needs, and preferences to determine if a change is needed in your coverage

Comparing the upcoming year’s plans to find the best-fitting coverage for you

Helping you transition to new coverage during the new year, if applicable

Laughing with you at some of the ridiculous advertising!

Money matters

Helping you understand Medicare’s costs is a key part of my role. If applicable, I can also help you:

Assess income-related implications

Anticipate IRMAA surcharges (Income-Related Monthly Adjustment Amounts)

Appeal IRMAA determinations

Apply for Medicare Savings Programs and Low-Income Subsidies (“Extra Help”)

Understand your options if you have Medicaid

Find Medicare plans that maximize your savings and benefits while minimizing your financial risk

ACA, ancillary, and non-traditional health insurance options

As a licensed health insurance broker, I can help with more than Medicare insurance matters. For individuals and families under the age of 65, I can quote and compare health insurance plans both on and off the Marketplace Exchange (ACA). I am also contracted with several dental and vision plans. In addition, I can discuss whether a medical cost-sharing ministry might be a suitable option instead of traditional insurance.

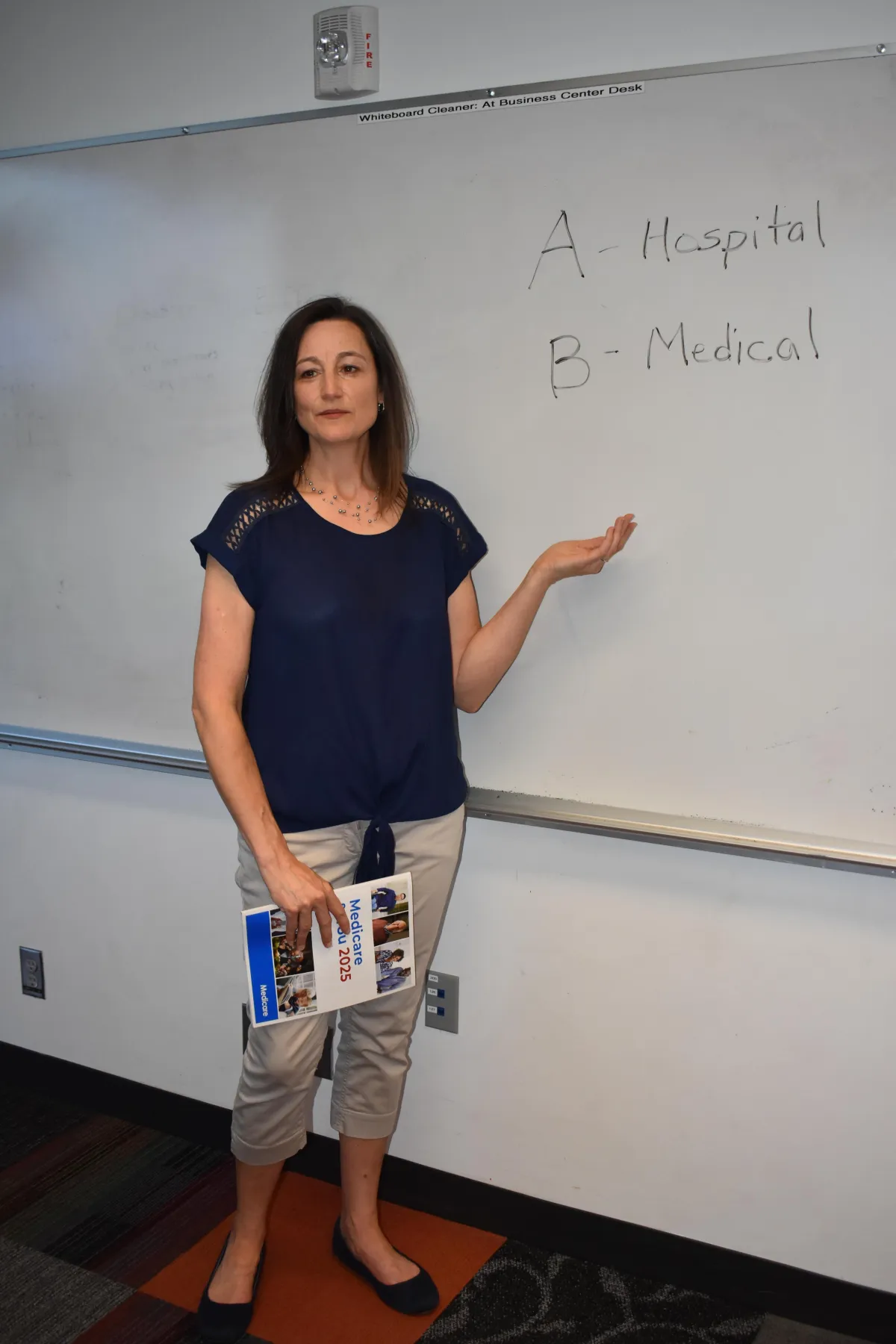

Education

Knowledge is foundational. In the realm of Medicare, it’s the basis for making good decisions and avoiding costly mistakes. Whether one-on-one or in front of an audience, I love educating people about Medicare. Here are some of the settings where I teach:

One-on-one tutorials (e.g. someone approaching age 65)

Seminars for the public (e.g. Medicare 101 presentations)

Employer-sponsored seminars for employees

Educational presentations for tax, accounting, financial, and retirement professionals

Seminars for clients of the above professionals

Consultations with Human Resources personnel and Employer Plan Administrators

“Lunch and Learns” for medical staff

Senior events

Webinars for all the above

Testimonials

New to Medicare

Being new to the Medicare system seemed very overwhelming to me, as I began to be bombarded with mail from both Medicare & various insurance companies, a good 6 months before turning 65. A friend recommended Maggie. We made an appointment to go over the process of registering & options. I’ve been pleasantly surprised at how painless Maggie made this new adventure for me. She’s very knowledgeable and always happy to answer new questions as they arise. I would & will highly recommend her.

--Lori C.

Amazing Agent!

After much frustration dealing with Social Security and Medicare, Maggie has truly been a God Send. She was very thorough in presenting me with multiple options for my health care. Early on I explained to her that I am blind and use assistive technology to access print materials. She has been diligent in making certain I am able to access any materials she sends me. She has spent a great deal of time making sure I have what I need.

-- Bertha A.

Five stars

Maggie is phenomenal. She knows how to explain and she gave us the understanding to master all the information related to medicare. She was also friendly, approachable, and answered all our questions in a very professional manner. I will give her 5 stars, great job.

--Daniel & Yolie G.

Maggie makes Medicare NOT a bad word!

The words 'Medicare' and 'cheerful' should never be used in the same sentence, unless you add, 'Maggie' to the mix. She competently and cheerfully helps navigate the infinite choices and overwhelming options available to me, the consumer. I will NEVER make another Medicare move without Maggie's counsel.

--Sharon L.

Outstanding

Maggie took the time to totally understand my needs. I have a lot of health issues and very expensive medications. She met with me the first time just to understand what type of coverage I needed. She then came back to discuss which insurance she found that would be best for me. I have called her several times to ask questions and she made sure I was comfortable with my choices.

She is patient and helped me through this difficult process. I would recommend her to others as a very professional individual who’s goal is to take care of their client and ensure they have the right insurance to meet their needs.

-- Michele M.

Medicare journey

As we got close to 65 years old, we were inundated with all kinds of materials and offers related to Medicare. Maggie helped us navigate the chaos and find several plans that were right for us. She was thorough, responsive, and helpful and was careful to let us make the final decision. Her support continued after enrollment, as she checked back to make sure our coverage was meeting our needs.

We’ve already recommended Maggie to our friends and family members and will continue to do so. She’s relatable and professional and we’re so very grateful we found her!

-- Ann & Rich

Frequently Asked Questions

Is there really no cost to use your services? How do you get paid?

There is never a fee for my services. I am paid a commission when I enroll someone in a health insurance policy (with exceptions). Each year, Medicare sets standardized commission rates for Part C and Part D plans.

What can I expect if I contact you?

I – and no one else-- will receive your communication. I try to respond the same day, if not the same hour. Your personal information is always protected, never shared. Ideally, you and I will have a short introductory phone conversation. I will only call you if you give me permission to do so. That’s the law and I’m a rule follower!

Then what happens?

Together we can decide on the next steps. Typically, we schedule an appointment to go deeper in addressing your situation, questions, options, etc. I can meet in person, by phone, or via Zoom, whatever works best for you.

Will I pay more if I use your services?

No, never. The rates I quote are the exact same as those you’d get direct from insurance companies. No mark-ups. Being independent, I can shop and compare plans from many carriers—large and small--to present you with the best-fitting options at the best value.

Are you partial to certain insurance plans or carriers?

I strive to remain neutral while being upfront/honest. I do not steer clients, and I caution you to avoid anyone who does! I will gladly share all that I know to help you reach an informed decision with peace of mind (e.g. insurance company/plan ratings, my clients’ experiences, my own insights, etc.).

Do you agree with what my friend says about Medicare Advantage plans? Which Medicare option/plan is the best?

Unless you and your friend are identical—you share the exact same medical needs, healthcare preferences, locality, lifestyle, budget, etc.--it’s unlikely the same plan will be the best fit for you both. Medicare Supplement (Medigap) and Medicare Advantage plans each serve the right person well. After you and I thoroughly evaluate your unique situation and compare options, you’ll have peace of mind about making the decision that’s right for YOU. Beware of agents who insist on only one plan type, one carrier, etc. They may have their own best interest in mind, not yours.

(719) 301-9303

7035 Hillbeck Dr, Colorado Springs CO 80922

Copyright © 2026 PeakMedicareSolutions.com

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program to get information on all of your options. This is a proprietary website and is not associated, endorsed or authorized by the Social Security Administration, the Department of Health and Human Services or the Center for Medicare and Medicaid Services. This site contains decision-support content and information about Medicare, services related to Medicare and services for people with Medicare. If you would like to find more information about the Medicare program please visit the Official U.S. Government Site located at http://www.medicare.gov.